As a Wyndham Diamond member, I recently navigated my first timeshare presentation and, spoiler alert, it was worth it—just not for the reasons they’d hoped. Here’s the full story, from the initial offer in February to my Las Vegas experience this November.

How It Started

Back in February, I called Wyndham to check availability for a last-minute trip to Margaritaville in the USVI. Unfortunately, the resort was fully booked. During the call, a representative offered the usual 500 points for listening to a Club Wyndham pitch. However, as a Diamond member, I was eligible for 60,000 Wyndham points if I attended a two-hour timeshare presentation.

The promo included:

- 4 days/3 nights vacation at a destination of my choice.

- Offer valid through December 31, 2024.

- Taxes and fees extra, ranging from $10-$75 per night.

I paid $279 for the package, using my travel rewards card to earn 3x points on hotels.

The Details

While I initially planned to redeem the offer for Destin, FL, my hectic travel schedule delayed my booking until November. With limited options, I decided to align the vacation with an existing trip to Las Vegas.

Here’s what I received as part of the promo:

- 3 nights at Hyatt Place in Las Vegas (I chose this over Club Wyndham properties for the additional perks—more on that below).

- A “Spend a Night on Us” coupon worth $175 for a future two-night stay.

- Taxes of $38 for the 3-night stay (not included in the upfront cost).

By waiting until November to book, I also received an additional 7-day RCI Getaway Certificate (valued at $1,499), part of a Veterans Day promotion Wyndham was running at the time.

Why I Chose Hyatt Place

Although I could have stayed at properties like Harrah’s, Paris, or Horseshoe (thanks to Wyndham’s partnership with Caesars), Hyatt Place made the most sense for stacking benefits:

- World of Hyatt (WOH) Perks:

- Earned 3 elite night credits, bringing me closer to 80 nights for the year and unlocking an additional Guest of Honor award and another Suite Upgrade Award, which I plan to use for a future luxurious stay.

- Hyatt was running a 2x points promo for stays at Hyatt Place and Hyatt House, which further boosted my earnings.

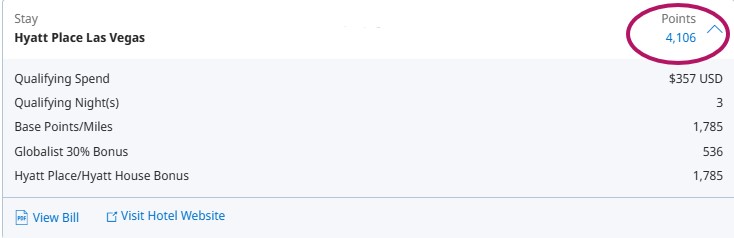

- Double Dipping: By linking my reservation, I earned points on the cash rate Wyndham paid for my stay.

For a seasoned points enthusiast, the choice was clear.

The Timeshare Presentation

The day of the presentation, I scheduled an early appointment (9 AM) at Club Wyndham Desert Blue in Las Vegas to get it over with before exploring the city.

Check-In Process

I arrived at 8:50 AM and was greeted by staff who verified my ID, income, and status (single, married, etc.). They required my ID and credit card at check-in, so be prepared. Snacks (coffee, cookies, and chips) were available while I waited for my host, who arrived promptly.

The Presentation

The presentation started out as a group, with all attendees watching a short video and a sales pitch highlighting the benefits of Club Wyndham properties and ownership. To stay on track, I set a 2-hour timer on my phone. After the initial sales pitch, we each went on a more individualized tour with our host, who showed us various properties that Wyndham offers worldwide. This was expected, as the host ultimately wanted to sell the timeshare.

During our conversation, the host requested my ID. I initially thought this was to pull up my Wyndham Rewards account, but then I recalled that I had already fully verified my information and checked in. Something didn’t seem right. She continued by saying, “We have to get you a qualified offer to see what you qualify for…” I stopped her immediately. It became clear she was attempting to conduct a hard credit pull without explaining her intentions when she asked for my ID. I had not given her consent to pull my credit reports, as I had no intention of making any purchases and wanted to avoid unnecessary inquiries. Moreover, I informed her that my credit reports were frozen.

She maintained that I needed a verified offer before we could proceed. Until then, I had been polite and cooperative, but I sensed that the sales tactics could become aggressive, and I was prepared to stand my ground. This was not what I had been told when I signed up for the tour; they had stated that I simply needed to attend the two-hour presentation.

Eventually, she consulted with her manager and returned with a solution that did not require a credit pull.

Pro Tip: Be cautious when handing over your ID. Always ask for clarification if you’re unsure why it’s needed.

Next came the mandatory condo tour, which showcased a beautifully staged suite designed to sell the timeshare dream. While it was impressive, I remained focused and polite throughout the experience.

The Hard Sell

After the tour, we returned to the office, and the host presented a package with a 17.99% interest rate, which I declined. As expected, she pressed for a reason and asked what would make me say yes. I remained firm, reiterating that I wasn’t interested.

This prompted the next tactic: bringing in a manager. The manager pitched a “rental” timeshare package designed to sound more appealing and significantly cheaper than ownership. As someone who brokers for clients, I’m no stranger to these tactics—it’s very common in the car dealership industry to escalate negotiations by involving a manager to offer a “better deal.”

Despite the added pressure, I stood my ground, politely declined again, and signed a decline letter. I was then escorted to the check-out area to claim my rewards.

Was It Worth It?

For 2 hours of my time, $279, and a little patience, I walked away with:

- 60,000 Wyndham points (almost equivalent to the sign-up bonus for the Wyndham Business card I got for 75K points with $2,000 spending requirement).

- A 7-day RCI Getaway Certificate.

- A “Spend a Night on Us” coupon worth $175.

Thanks to the stacking opportunities, I also earned 3 elite night credits and 14.5x points per $1 spent on the cash rate for my stay at Hyatt Place.

To put it in perspective:

- 60,500 Wyndham points can be worth up to $2,200 when redeemed strategically. (For example, I redeemed 67,500 Wyndham points for a 5-night stay in Maui through Vacasa, saving $2,500.)

- The RCI certificate and rebate coupon add even more value.

Final Thoughts

Timeshare presentations can be a test of patience, but if you set boundaries and stay focused on your goals, they can be worth it.

Here’s my advice:

- Research the offer to ensure it aligns with your travel plans and goals (I passed on many offers like this for significantly fewer points! Negotiate if you find a better deal!)

2. Set a timer to keep the presentation on track.

3. Be firm but polite when declining offers—they will push hard for a sale.

For me, the value far outweighed the effort. Have you attended a timeshare presentation? Let me know in the comments!