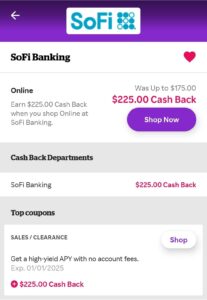

Rakuten has increased its cashback offer but for an extra 100 points, making it the highest offer to date for opening a Sofi Checking and Savings account!

You must direct deposit $500 within 45 days of opening a Sofi Checking and Savings account through your Rakuten account to earn 22,500 AMEX points or $225 cash back!

Additionally, Sofi also offers cashback for meeting specific requirements up to $300! That could be 22,500 AMEX MR points PLUS up to $300 cash!

Last year, P2 and I took advantage of this offer and stacked the two offers to receive 40,000 AMEX Membership Reward points and $550 cashback. These same points were enough to cover my business class flight to Spain this summer, which would have cost me $5,805 if I had paid in cash.

By taking advantage of offers like this, I was able to book some of my bucket list trips for nearly free!

This offer can be confusing, so step-by-step instructions are included, including how to trigger the required Direct Deposit without a formal employee or government DD.

- Open the Sofi Banking offer through Rakuten

- Open a checking AND savings account.

- Fund the account $500

- Set up direct deposit from your employer or government agency (such as SSC, unemployment etc) to your new account ($500 or more if you only want the Rakuten cash back, $5,000 or more if you want to trigger BOTH offers)

Alternative to Step #4

Sofi is very strict on what qualifies and triggers a direct deposit. However, I have discovered a process that has worked for me, as well as for P2 and a few others whom I referred and assisted. We were able to successfully trigger the direct deposit using Chase Business Checking ACH. If you do not have a Chase Business Account set up, earn $400 for this bonus as well when you open the account using my link:

So, if you stack all these, you can potentially earn $700 cash PLUS 22,500 AMEX MR points in just a few easy steps!

- Open a Chase Business Checking with my link in the comments

- Process an Employee ACH transfer of $5,000 to your new Sofi Checking account within the qualification period which is 30 days (per Sofi T&C) You can do multiple transactions that equal $5,000 or more. However, I just pushed the $5,000 at one time and then pulled my money out after a few days

- Open your Chase Business Checking

- Go to Pay & Transfers

- Enroll in ACH payment services

- Schedule Payment

- Add Payee (which is yourself)

- Complete transfer (there will be a small fee)

Please note: The Chase Money Movement department may contact you on your first ACH transfer to confirm, but after that, you should be good for any additional ACH payments you process

Be sure to carefully review and understand the terms and conditions of both offers to avoid any issues with receiving the bonuses.

If you don’t have a Rakuten account yet, earn an additional $40/4,000 AMEX Membership Reward by signing up today with the link here!

2 Responses

You’re a beast in these points streets🤑 Thanks for the intel!

I do not have a chase business checking, but I have a different business checking, an Amex Business checking, could that work?