Late last year, I, along with a few others in the travel and points community, hinted at changes coming to the Dell Technologies credit on one of our favorite premium business cards. While many feared the benefit would disappear entirely, the credit hasn’t been eliminated—but it is being restructured in a big way. There’s also an update to the Adobe benefit, and depending on how you use the card, these changes could be a win or a loss.

Let’s dive into the updates for both.

Dell Technologies Credit: What’s Changing?

Historically, this card offered up to $400 per year in statement credits toward purchases with Dell Technologies—$200 semi-annually.

While some found this benefit useless, I actually enjoyed it and received lots of useful free items(after the credit was applied). Not to mention the base points earned from the card, occasional cash back offers from the issuer, Dell credits, AND more points from using one of my favorite shopping portals, Rakuten, for the purchase.

Here’s the breakdown of what’s changing now:

Through June 30, 2025:

-

You’ll still be eligible for up to $200 in statement credits on purchases made directly with Dell Technologies.

-

Purchases must be charged to an enrolled account, and both the primary cardholder and employee cards can take advantage.

Between July 1 – December 31, 2025:

-

You’ll get up to $150 in statement credits for the entire year on Dell purchases.

-

In addition, if you spend $5,000 with Dell during that same period, you can unlock an additional $1,000 in statement credits—bringing the total potential to $1,150 in Dell credits for the second half of the year.

Starting in 2026:

-

The standard Dell benefit will be $150 per calendar year.

-

That $1,000 kicker will remain, but only if you spend $5,000 or more in a calendar year with Dell.

While this means a cut from the easy $400 many of us were used to, high spenders may find upside in the $1,000 opportunity. The change is less favorable for those who don’t buy from Dell frequently or find it tough to hit the $5K threshold.

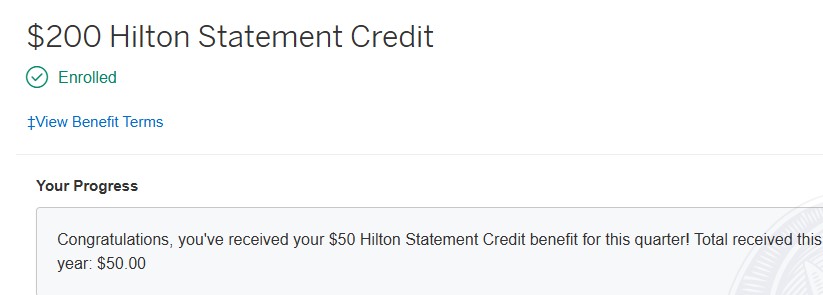

Back at the end of last year, they also added $200 in Hilton Honors credits—$50 in quarterly credits, which was rumored to be replacing the Dell credit. Looks like that was somewhat true, though they didn’t completely axe the benefit altogether. You can read more about that update here.

Adobe Benefit: An Upgrade (for Some)

The Adobe credit also saw a refresh that could be beneficial, especially for those who use Adobe software regularly in their businesses.

Through June 30, 2025:

-

Cardholders can earn up to $150 in statement credits on eligible Adobe purchases, such as annual prepaid business subscriptions for Adobe Creative Cloud or Acrobat Pro for teams.

Starting July 1, 2025, and beyond:

-

You’ll now be eligible for a $250 credit when you spend $600 or more on qualifying Adobe purchases in a calendar year.

This increase in value is great news—if you were already spending that much. However, you’ll need to spend at least $350 out of pocket to access the full credit.

Note: Individual and student plans don’t qualify—this benefit is strictly for business-use subscriptions purchased directly from Adobe.

Final Thoughts

While these changes indicate a shift, they aren’t entirely negative. The Dell benefit may be more challenging for some to utilize, but the potential $1,000 bonus could be significant for businesses that already have substantial tech budgets. Additionally, you can still receive up to $350 in Dell credits this year, which means there’s only a $50 loss in benefits. This loss can be easily compensated with the $50 Hilton statement credits. Meanwhile, the Adobe benefit effectively represents a $100 increase if you meet the spending threshold.

That said, I still find these changes disappointing. I’ve long valued this card’s easy-to-use credits, and now I’ll need to find a way to get my Adobe charge in before June to avoid missing out. It’s not enough for me to get rid of the card—I still enjoy most of the benefits—but it’s a reminder to always keep tabs on what’s shifting.

As always, these updates highlight the importance of reviewing your benefits regularly and aligning them with your business needs. If this card is part of your strategy, you’ll want to track spend more intentionally to make the most of the evolving perks.

Want help optimizing your business credit card setup? Or wondering if this card still belongs in your wallet? Reach out—I’d love to help you navigate it.