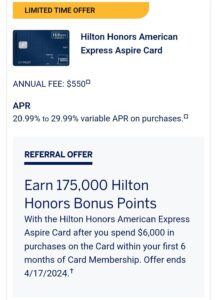

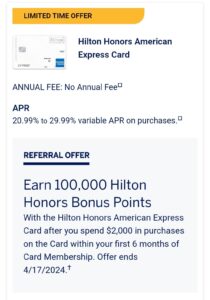

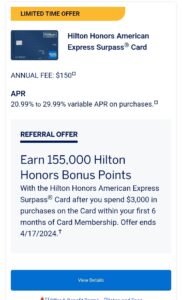

American Express (AMEX) recently released elevated offers on personal Hilton Honors cards. These offers are close to, if not the highest offers we’ve seen on these cards. You can earn 175,000 Hilton Honors points when you spend $6,000 in 6 months on the Hilton Aspire Card. The offers on other two cards are 155,000 Hilton Honors points with $3,000 spend on the Surpress Card and 100,000 Hilton Honors points with $2,000 spend on the Hilton Card. These offers are valid until April 17th.

However, the business version of the Hilton Card still has the standard offer. So, it may be a good idea to wait for a better offer. Last May, the elevated offer on the business version was 150,000 Hilton Honors points along with a Free Night Certificate for up to 150,000 points on standard nights. Be sure to check out my recent post on Hilton Honor redemption sweet spots!

It is important to note that these cards will impact your 5/24 status, so be strategic when deciding to go for thi.

Click here to look into these offers and apply!